What is Payment Gateway?

A payment gateway is a merchant service provided by an e-commerce application service provider that authorizes credit card or direct payments processing for e-businesses, online retailers, bricks and clicks, or traditional brick and mortar. The payment gateway may be provided by a bank to its customers but can be provided by a specialized financial service provider as a separate service, such as a payment service provider.

A payment gateway facilitates a payment transaction by the transfer of information between a payment portal (such as a website, mobile phone or interactive voice response service) and the front end processor or acquiring the bank.

Types of Payment Gateway System

There are 2 types of Payment Gateway system available:

1) Hosted Payment Gateway

This system redirects customer outside from e-commerce site to payment processing page of the selected gateway and later when the payment transaction is completed customer is redirected back to the site. PayPal, WorldPay, etc. are some reputed providers of the Hosted Payment Gateway.

2) Shared Payment Gateway

This system directs the customer to the payment page but stays in the application. This Gateway system doesn’t leave the e-commerce site while the payment is processing this way it’s simple, sought after and safe such as Stripe and eWay.

What’s the Difference Between Payment Gateways, Payment Processors, and Merchant Accounts?

If you’re new to online payments, you’ve probably heard people discuss payment gateways, payment processors and merchant accounts.

A Payment Gateway is a mediator between eCommerce sites and the payment processor. This system securely authorizes payments for your eCommerce websites.

What is a Merchant Account?

Payment gateways are often confused with merchant accounts. To take payments online you need both a payment gateway and a merchant account. A merchant account is where funds are held before being deposited into your bank account. The role of the payment gateway is simply to decline or approve a transaction.

What about a Payment Service Provider?

Payment Service Providers (or PSPs) act as both a merchant account and the payment gateway, helping businesses to collect and manage their payments. Payments go to the PSP and are then transferred on to you.

How does a payment gateway work?

There are four simple steps in the payment gateway process:

1. Collection

Your customer chooses the product or service they want to purchase and then enters their credit card details onto your payment page. This information is then directed to your payment gateway.

2. Authentication

Your payment gateway then takes this information and sends it via a shielded link to your bank account.

3. Authorization

At this point, you will know that the sale has been approved and you can deliver the ordered products or services.

4. Settlement

At last, the transaction data is verified by your bank and the money from the sale is deposited into your account. When the actual payment will arrive in your account will depend on your payment gateway – it can be as little as real-time or as long as 21 working days.

For example, with even the best payment processing services, it will be you who gather and analyze payments and then redirect them to your account. With a gateway, on the other hand, compliance and transfer are provided by a third entity (online payment processing companies), so that you don’t have to worry about transfer delays or, worse, glitches.

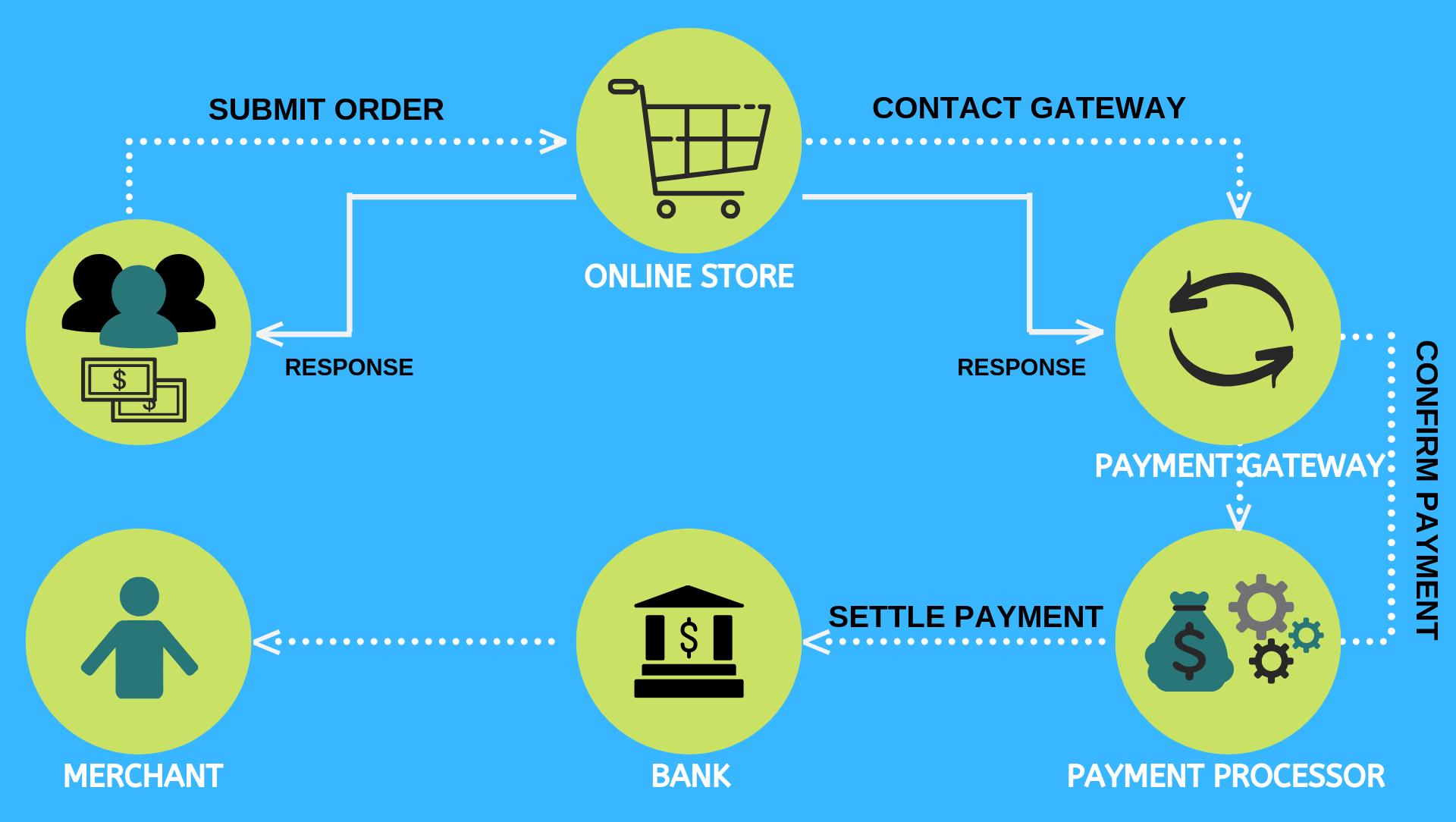

In the above example the gateway process follows these six steps:

In the above example the gateway process follows these six steps:

Step 1: The customer places an order and enters their payment information. An online transaction will be processed as a “card-not-present” transaction. Again, this may result in a higher processing rate. Once this info has been submitted, it’s encrypted, and then sent on its way.

Step 2: The encrypted data is first sent to the merchant’s processor, which is simply the company that actually processes the transaction.

Step 3: The processor routes the transaction data to the credit card association. Visa, MasterCard, Discover, or American Express are credit card associations. These card associations charge an interchange fee for each transaction.

Step 4: The next step is where the transaction is approved or denied. The card will obviously need to be valid and have enough funds.

Also in the fourth step, the authorized user must also not have any holds or freezes and the transaction will be authorized. What’s amazing is that these first four steps take place in a matter of seconds!

Step 5: The transaction becomes authorized. The issuing bank then transmits the authorization back to the parties in the payment processing network.

The authorization starts with the credit card association, then with the merchant’s business. Finally, back to the eCommerce site through the payment gateway.

Step 6: Although the transaction only takes seconds, it can take between 24 to 48 hours for the funds to be available in your account.

How secure is the payment gateway?

Security is obviously a key concern when taking payments. You should make sure you only use a provider which is level 1 compliant with the Payment Card Industry Data Security Standard (PCI DSS) and that offers built-in security capabilities (such as tokenization).

You should also consider the fraud protection and screening tools offered. Most payment gateways offer a number of tools to help you guard against fraud, such as filters to define who or where you receive payments from. These tools are particularly important if you will be accepting payments from people who you don’t have an existing relationship with.

What types of cards are accepted by the Payment Gateway?

Payment gateways typically accept VISA, Mastercard and most accept American Express. Paypal is also becoming popular for online payments. If you’re collecting international payments you may want to check that the gateway supports local credit card types (e.g beyond Visa, Amex, MasterCard, and Discover).

Does the payment gateway offer automatic recurring payments?

If you want to take recurring payments you may want to look for a system that will store your clients’ credit card numbers and let you automatically charge them on a recurring basis. Many gateways now have this feature, but in almost all cases they also require your business to have an online merchant account. PayPal Standard, Google Checkout and some others are unable to handle this kind of pre-authorized transaction

Things to be considered before Selecting Gateway Package

Transaction Fees: When the payment transaction is done, few gateways will charge you for letting you use their app. You will either pay a flat fee per each transaction, or a defined percentage commission of each purchase value or a combination of both charges.

Card Types: It’s essential knowing the types of credit/debit cards accepted by the selected payment gateway.

On-Form Payments: If there is a pre-built form integrated with a payment gateway to collect funds, the site owner should pay attention to this section. Few gateways will collect payment straight from the given form, while others will take users to a separate page to complete the purchase transaction.

What do you need to consider while choosing Payment Gateways In India?

1. Security & Trust

2. Reliability

3. Good Rates

4. Diversity

5. Superior User Experience

6. Easy Integration

7. Multiple Payment Options (Credit/Debit Cards, Netbanking, Mobile Wallets, etc)

Best Payment Gateways in India

CCAvenue

CCAvenue is one of the prevalent payment gateways in India. Here is what it offers:

– 200+ payment options that include 6 Credit Cards, 58+ Net Banking, 98+ Debit Cards, 12 Prepaid Instruments,13 ATM Cards, 14 Bank EMI

– Supports 27 major foreign currencies, like Indian Rupee, American Dollar, Singapore Dollar, Pound Sterling, American Dollar, Bahraini Dinar, UAE Dirham and many more

– 18 Major Indian & International Languages.

– Zero initial setup fee.

– Rs.1200 annual maintenance fee

– Mobile App Integration: Android, iOS, and Windows thus enabling you to serve customers in some major global markets even outside India.

– Check it out: www.ccavenue.com

PayUmoney

PayUmoney provides a cutting edge state-of-the-art payment gateway solutions to online businesses through its award-winning technology. It is a subsidiary of the conglomerate PayU India

– A wide range of payment options includes debit and credit cards from all card associations, 50+ net banking, UPI payment mode as a default checkout option and digital wallets.

– Secure with 128 bit SSL encryption and two-factor authentication.

– Zero initial setup fee.

– Zero annual maintenance fee.

– App-ready with mobile SDKs for Android and iOS platforms.

– Faster activation time. They aim to give a safe and secure environment that allows anybody to make or receive payments.

– Check it out: www.payumoney.com

Instamojo

Instamojo is one of the fastest growing commerce enabling Payment platform. It is a full-stack transactional platform that is leading in payments & e-commerce for merchants in India.

– Accept All Payment Modes including Debit Card, Credit Card, Net banking, UPI, Wallets, and NEFT.

– Encrypted and Safe PCI-DSS Compliant Payments

– Zero initial setup fee.

– Zero annual maintenance fee.

– International Payment / Credit card Not supported

– No multi-Currency Support.

– No Mobile App Integration. API Driven Integrations. It’s flagship products being ‘payment links’ & ‘free online store’ that helps ease the processes for Small & Medium Businesses to get online.

– Check it out: www.instamojo.com

PayPal

PayPal is a global payment platform available in almost 200+ countries. If you aim to go international with your business collecting payments from international consumers, then Paypal is your best payment gateway option. PayPal does not support or recognize Indian currency, therefore you need to choose an international currency as the base currency.

– Payment methods available are Visa, MasterCard, American Express, Discover, JCB & Diner’s

– Supports multi-Currency. Paypal does not recognize Indian Currency, Rupee. And thus, it can only accept international payments by setting base currency as US dollars or other.

– Zero initial setup fee.

– Zero annual maintenance fee.

– Encrypted and Safe PCI-DSS Compliant Payments.

– Easy web Integrations and mobile App Integration available. In India, Users use PayPal to receive payments from foreign customers only as due to banking regulations an Indian company cannot accept Indian credit cards via PayPal.

– Check it out: www.paypal.co.in

Cashfree

Cashfree is India’s highly trustworthy and merchant-friendly payment gateway. Cashfree offers easy-to-use payment UI. It charges the lowest per transaction charges in India (For 70+ Net banking options)

– Payment option includes any card, 70+ Net banking options, UPI, Paytm & other wallets, EMI and Pay Later options.

– Zero initial setup fee.

– Zero annual maintenance fee.

– Supports up to 40 foreign currencies.

– Next day settlements.

– Easy Integrations and mobile SDK available.

– One-day activation. No annoying prompt for additional customer details and Customize the color and logo of your payment page as per your site design makes it the best user-friendly Platform.

– Check it out: www.cashfree.com

Razorpay

Razorpay is a payment solution available only in India (as of now). With this payment gateway, you can collect recurring payments & share invoices, etc. – all in a single platform.

– 100+ modes of payment including Credit/Debit card, Net Banking, UPI and wallets

– PCI DSS Level 1 compliant solution removing regulatory compliance.

– Razorpay Dashboard gives you Real-time data and insights

– Zero initial setup fee.

– Zero annual maintenance fee.

– Easy Integration. API Driven.

– Instant activation.

– No multi-Currency Support

– International cards/payments take longer for approval as a subject to bank approval. It provides access to all payment modes including JioMoney, Mobikwik, Airtel Money, FreeCharge, Ola Money and PayZapp. Fast forward your business with Razorpay.

– Check it out: www.razorpay.com

MobiKwik

MobiKwik Payment Gateway accepts payments through widespread Net Banking, Wallets, EMI, UPI, and almost all Indian and international MasterCard, Visa, Diners card, Discover, American Express.

– Supports major credit and debit cards, 50+ Net banking portals, International Cards, e-Wallets & Electronic – COD.

– Negotiable initial setup fee.

– Negotiable annual maintenance fee.

– No multi-Currency support.

– Encrypted and Safe PCI-DSS Compliant Payments.

– Easy web Integrations and mobile App Kits available.

– Claims Best conversion rate

– Lesser per transaction charges after Cashfree. Negotiable. It is used by online portals like TicketGoose, YepMe, ShopClues, and Snapdeal.

– Check it out: mobikwik.com

Paytm

Add Paytm Payment Gateway to your mobile app or website. Accept offline payments in your point of sale or self-service kiosk. Collect online and in-store payments from your customer using UPI, Debit/Credit Cards, 50+ NetBanking options, EMI and Paytm Balance.

– No maintenance charges.

– Zero setup cost.

– No AMC.

– They charge a flat commission of 0% per transaction. And, additional GST of 18%

– They support all domestic debit and credit cards.

– Net banking of over 50 banks.

– Only INR is supported right now. Multi-currency transactions or support, none is available at the time of writing.

– No Withdrawal fees.

– International credit cards are not supported.

– All the settlement is made to the bank account within the transaction date +1 day. The first settlement may take 4 to 5 working days.

– Customer support is excellent. They are available throughout the week.

– Bank account details and business registration related documents are needed. Within 2 days after submitting, you can go live with your Paytm Payment Gateway.

– It gives plugins for major E-Commerce platforms namely Magento, OpenCart, PrestaShop, CS-Cart, WooCommerce, WordPress, etc.

– The server site utilities are PHP, Java, Python, Ruby on Rails, ASP.NET, Express, Google App Engine, Perl, and Node.Js.

– Check it out: https://paytm.com/

References:

https://en.wikipedia.org/wiki/Payment_gateway

https://www.technetexperts.com/web/payment-gateway-testing-what-types-dos-donts/

https://gocardless.com/guides/posts/payment-gateways/

https://due.com/blog/what-is-a-payment-gateway/

https://www.thinkcode.co.in/list-of-payment-gateways-india/

https://phoeniixx.com/top-10-payment-gateways-in-india/